The construction sector in Crete, Greece has made a significant recovery from a recession in 2021, but it has also experienced several significant headwinds that are expected to persist in 2022. In this article, we investigate the construction activity in Crete, Greece in an effort to provide valuable insights to property investors and buyers.

Table of Contents

Impact of COVID-19 on the Construction Sector

The COVID-19 pandemic is definitely not just a short-term crisis. It has long-lasting consequences for how the construction sector behaves and how supply chains function. Business continuity, safety, and risk management in residential and commercial construction projects are very important to create long-term business resilience for managing future challenges.

This requires knowledge sharing and value creation. Construction firms in Crete should consider developing an effective framework that includes a responsive and resilient risk management plan combined with fully integrated operational excellence strategies.

That synergy should be technology-led, leveraging platforms that support data analytics, artificial intelligence and machine learning. It should also ensure end-to-end transparency across the entire life cycle of a construction project.

For more details call us today at 0030 2821112777, email info@arencos.com or visit our website at arencos.com to discover more.

Coming off a whirlwind of a year, the construction industry in Crete, Greece will continue to grow and innovate in 2022.

Construction Sector Facts & Trends For 2022 & Building Activity

According to the National Statistical Service of Greece, construction output in Greece rose 3.7 percent from a year earlier in the third quarter of 2021, easing from a 4-year high of 16.2 percent growth in the second quarter as low base effects begin to fade.

Building activity soared 27.0 percent (vs 25.4 percent in Q2), the highest reading since at least 2016. On the other hand, civil engineering works decreased by 9.5 percent (vs a 9.8 percent rise).

Many reports over the remaining part of the forecast period (2022-2025), indicate that the country’s construction sector should record an average growth rate of 2.6% between 2022 and 2025. The sector’s output will be supported by improving investor confidence and investments in transport, renewable energy, and residential and commercial infrastructure projects.

The government is focusing on the development of massive renewable energy projects, in line with its target to increase the share of renewable energy in the total energy mix by 35% over the next 10 years. The plan involves a target of producing 7.7GW of solar PV and 7GW of onshore and offshore wind capacity by 2030.

An increase in building permits and foreign direct investment (FDI) in construction will also contribute to the industry’s growth momentum in the early part of the forecast period.

According to the ELSTAT, the number of building permits issued in the country registered a growth of 36% in the first four months of 2021, increasing from 5,272 during January-April 2020 to 7,172 during January-April 2021.

The Boom in Building Permissions

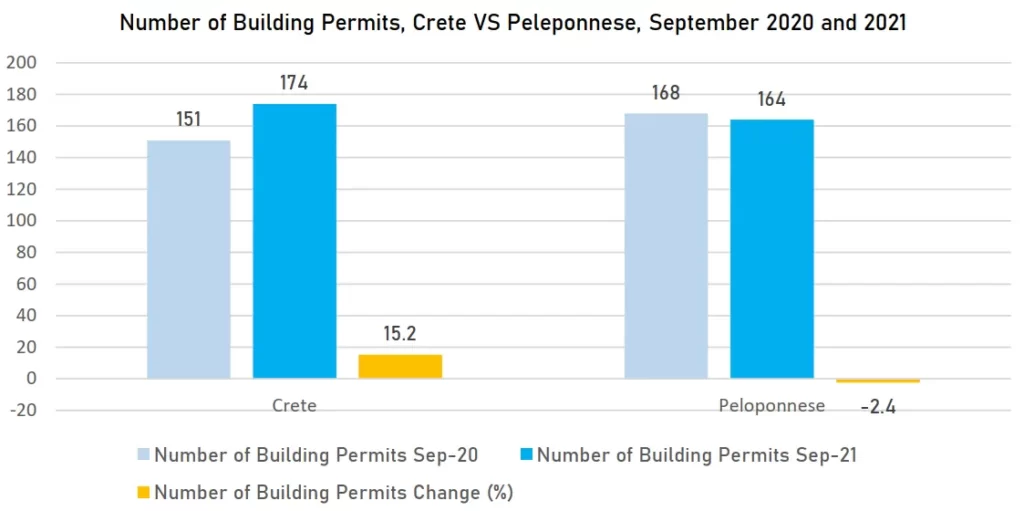

The Total Building Activity (private-public) in Greece, in September 2021 which is calculated on the basis of the number of issued building permits, amounted to 1,982.

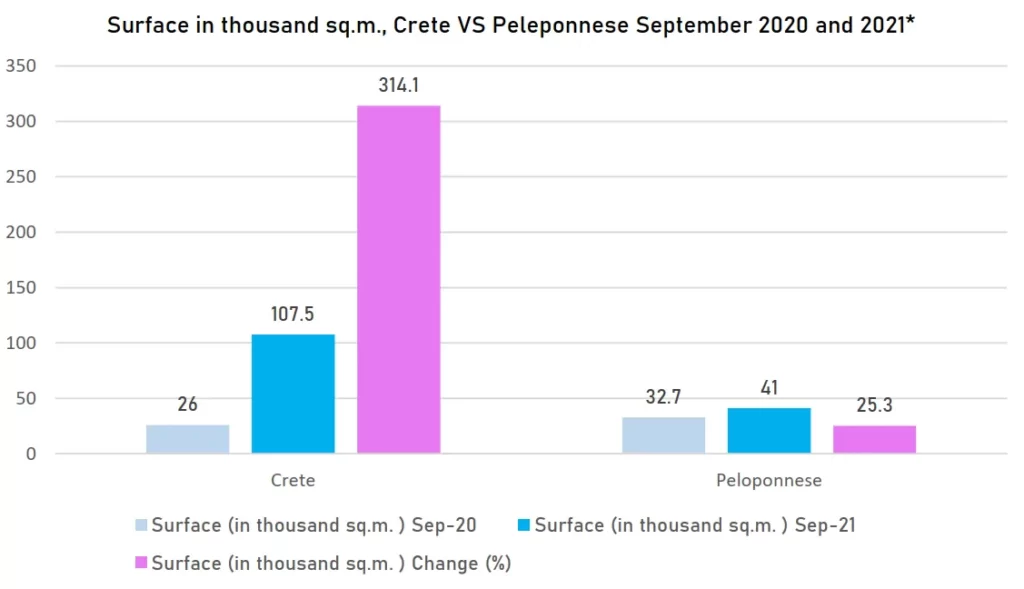

This figure corresponds to 728.1 thousand m2 of surface and 3,118.9 thousand m3 of volume, reflecting, respectively, an 11.2% increase in the number of building permits, an 85.1% increase in surface, and a 102.3% increase in volume, compared with the corresponding month of 2020.

The building permits for the Private Building Activity issued in Greece in September 2021 amounted to 1,973. This figure corresponds to 709.1 thousand m2 of surface and 2,963.9 thousand m3 of volume. In comparison with the same month of 2020, there is an 11.5% increase in the number of building permits, an 82.2% increase in the surface and a 95.5% increase in volume.

From October 2020 until September 2021, Total Building Activity (private-public) in Greece, calculated on the basis of the number of issued building permits, amounted to 22,596. This figure corresponds to 5,879.3 thousand m2 of surface and 24,529.5 thousand m3 of volume.

In comparison with the corresponding period from October 2019 until September 2020, there is a 17.7% increase in the number of building permits, a 42.5% increase in the surface and a 39.3% increase in volume.

In the same period, from October 2020 until September 2021, Private Building Activity in Greece recorded a 17.7% increase in the number of issued building permits, a 40.7% increase in the surface and a 35.8% increase in volume, compared with the corresponding period from October 2019 to September 2020.

The Construction Outlook For 2022 is Looking Positive, But the Sector Will Face Challenges

The construction sector in Crete responded well during the pandemic and has come out strong in the post-recession recovery period. Total construction spending recovered and seems that will peak at a record high (approximately 8% higher than 2019 average levels signaling consistent expansion in construction projects and real estate investments in Crete.

In a recent survey conducted by ARENCOS, 82% of the respondents characterized the outlook for their investment portfolio as somewhat or very positive, 33% higher than last year.

Driving this business confidence is the expected strong performance of both commercial and residential construction projects. Looking into the two segments in more detail, residential projects in Crete continued to stay strong despite the fact that construction materials have experienced significant rates of price increases and the spread of the coronavirus Delta variant.

The housing construction sector showed strong growth and also experienced noteworthy progress across both single – and multifamily new projects.

Related Read:

Construction Activity in Crete – Key Trends And Prospects to 2022